Service contractors are the lifeblood of energy sector: CAOEC

Modest growth in drilling predicted for 2024

Growth is on the horizon for energy service contractors in the Western Canadian Sedimentary Basin. After seven years of difficulty and uncertainty, the Canadian Association of Energy Contractors (CAOEC) is anticipating sustained demand for energy services in 2024, especially for drilling and service rigs.

“These businesses and workers are the life blood of Canada’s energy sector,” said CAOEC president and CEO Mark Scholz at the release of 2023 State of the Industry Report. “They help drill and produce Canada’s subsurface resources, creating thousands of mortgage-paying jobs and providing Canadians with secure and affordable energy to heat their homes, power their schools and hospitals and provide the necessary transportation across our vast and great country.”

This demand for drilling and service rigs will require the recruitment and development of a new generation of drilling and service rig employees. It will take time to resolve the labour shortage. With all positions in high demand, these challenges will persist into 2024.

“There’s no silver bullet. We must rebuild the workforce from previous years of contraction and lack of stable activity,” Scholz said.

The increasing use of decarbonization technology, and the ongoing transformation of the oil and gas sector will require the development of new skills alongside the technology.

“The drilling and service rigs of the future will require unique skill sets and diversity of talent as we embrace new automation, artificial intelligence and carbon-abatement technologies.”

Exciting new opportunities are being created in the industry for the extraction of critical minerals such as lithium and helium, the production of heat and power from geothermal and the sequestration of carbon deep underground. Today’s rigs can work on a natural gas well in one period, move to a geothermal or carbon storage well in the next, and drill exploration wells for lithium or helium.

“By building off Canada’s world class drilling technology, the energy services sector is at the epicentre of sustainable jobs and Canada’s energy transformation,” Scholz said.

Decarbonization is going to continue, and Canada must decide if it’s serious about taking on a leadership role in world energy. But if Canada is to lead, Scholz says public policy must be anchored in pragmatism and designed to support energy contractors. There are readily available technologies that could significantly reduce emissions, such as bi-fuel engines, battery systems and hydrogen blending.

“Unfortunately, there are significant policy gaps in the Federal approach to decarbonization. If aspirations are to be turned into investments, Ottawa needs to be more flexible and not choose one sector over another. Emissions reduction should not be incentivized depending on its area code,” he said.

The government’s own data shows that conventional oil and natural gas are on a path to decarbonization. Methane emissions in BC are down by 50 per cent. With the subsurface technology in use in the WCSB, producers can store CO2 safely.

“We are ready to do our part and position Canada as the world leader in carbon efficiency, but we can only achieve this through policies that recognize the real-life applications of drilling and service rigs.”

The future of the workforce, and the energy security of communities across the country depend on the government getting it right.

Building more infrastructure is key to maximizing Canada’s potential. As Grant Fagerheim, president and CEO of Whitecap Resources said, “Infrastructure is a principal driver for everything that we do, from a pricing perspective and getting our products to markets.” Right now, our products aren’t getting to foreign markets. They go to the US, but not offshore.

Fagerheim says that we must respect and appreciate what Shell Canada has done for the natural gas industry, with the Coastal GasLink and LNG Canada projects. These projects and their associated infrastructure will soon be getting British Columbia’s energy products to foreign markets.

“The 1.8bcf/day of LNG Canada is going to be helpful and help the system, but we need more infrastructure development for our products,” Fagerheim said.

There is so much potential in western Canada in the oil and gas industry. From job opportunities to Indigenous partnerships to the development of new products. These new products amount to energy addition, not replacement or transition.

Lithium extraction for example, while a fairly new industry, uses many of the same processes as the oil and gas exploration and extraction. It will work differently in that a small company can’t drill a couple of holes and build a large company like you can with oil, according to Chris Doornbos, president, and CEO of E3 Lithium. A lot of engineering and geology reservoir development work goes into each field.

Doornbos says E3 is developing a two-year program, using five rigs to drill something like a hundred holes in southern Alberta to get the project operating.

Although Alberta has the greatest reserves of lithium in Canada, there are opportunities for lithium extraction in BC as well. It’s a good opportunity for jobs, and it’s all done using standard drilling equipment.

“We have an opportunity to create a new industry that uses all the same skill sets, workforce and expertise that we already have,” Doornbos said.

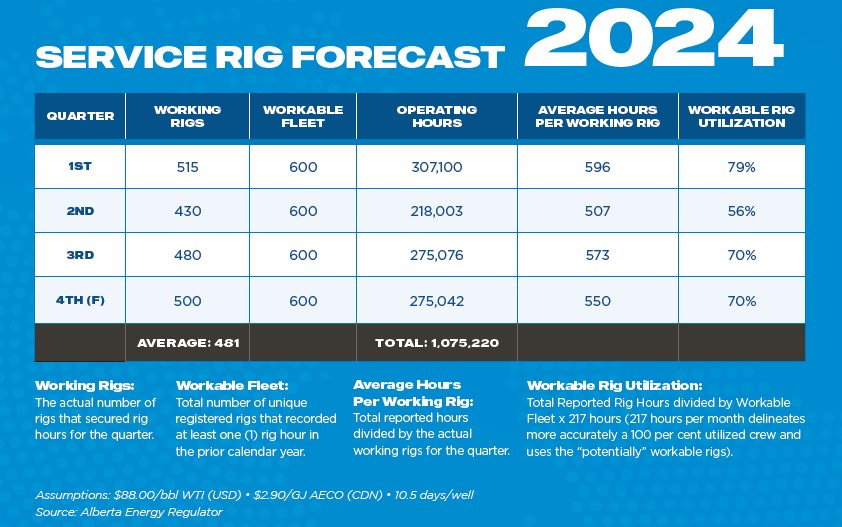

These opportunities are creating growth in energy services, especially drilling and service rigs utilizations. Looking towards 2024, CAOEC has produced its first ever service rig forecast.

“We’ve typically always put it on the drilling side,” said Scholz. That said, for the remaining quarter of 2023 CAOEC is expecting to have 445 working service rigs, 234,736 service operating hours, with an average utilization rate for the fourth quarter of 57 per cent.

Going into 2024, the forecast is for 481 working service rigs, and just over a million service operating hours at 1,075,220, with a rig utilization of 69 per cent. This amounts to a year-over-year increase of eight per cent in service operating hours.

On the drilling side, for the remainder of 2023, CAOEC expects to see a total of of 5,748 rig released wells. The fourth quarter is coming in at 185 rigs, and putting out 17,039 drilling operating days, which is 2.6 per cent higher year-over-year than 2022.

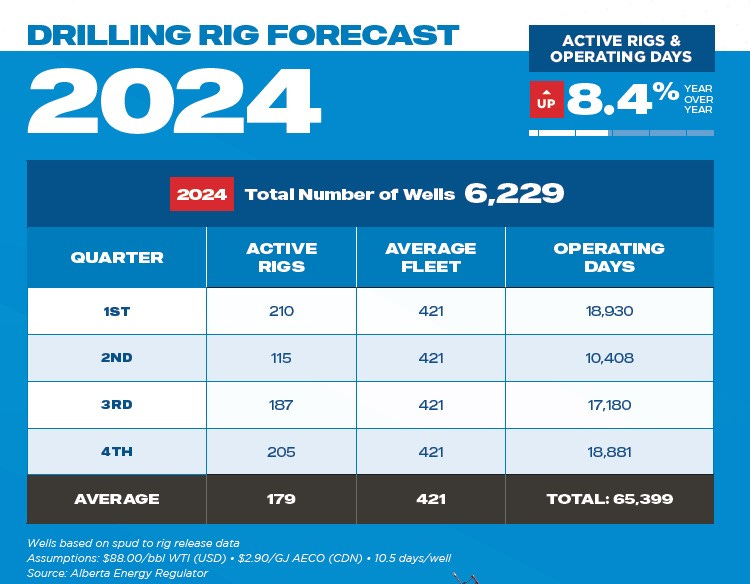

Scholz said that the exciting news for 2024, which will likely be focussed in the second half of the year, is an 8.4 per cent increase year-over-year in rig released wells, to 6,229. They’re looking to an average of 179 active rigs for 2024, which will give them approximately 65,399 drilling operating days.

We should be proud of our service sector. “There’s no sense in being humble anymore,” said Fagerheim. “We’re not quite where we want to be at this particular time as a result of some of the Federal policies and the advertising they do for our country, but we’ll get there and I really believe that people are starting to understand the competitive nature of investment, some of your greatest returns take place through the Canadian energy sector.”

Scholz agreed: “We’re incredibly blessed in the oil and gas industry.”