Only 14% of Broken Typewriter readers received a BC carbon tax rebate

Results of the Reader Survey, plus some thoughts

At last, here are the results of the survey the faithful readers of The Broken Typewriter participated in at the end of March. Thanks for your patience - I had this piece mostly written before my impromptu trip overseas - are these results what you expected?

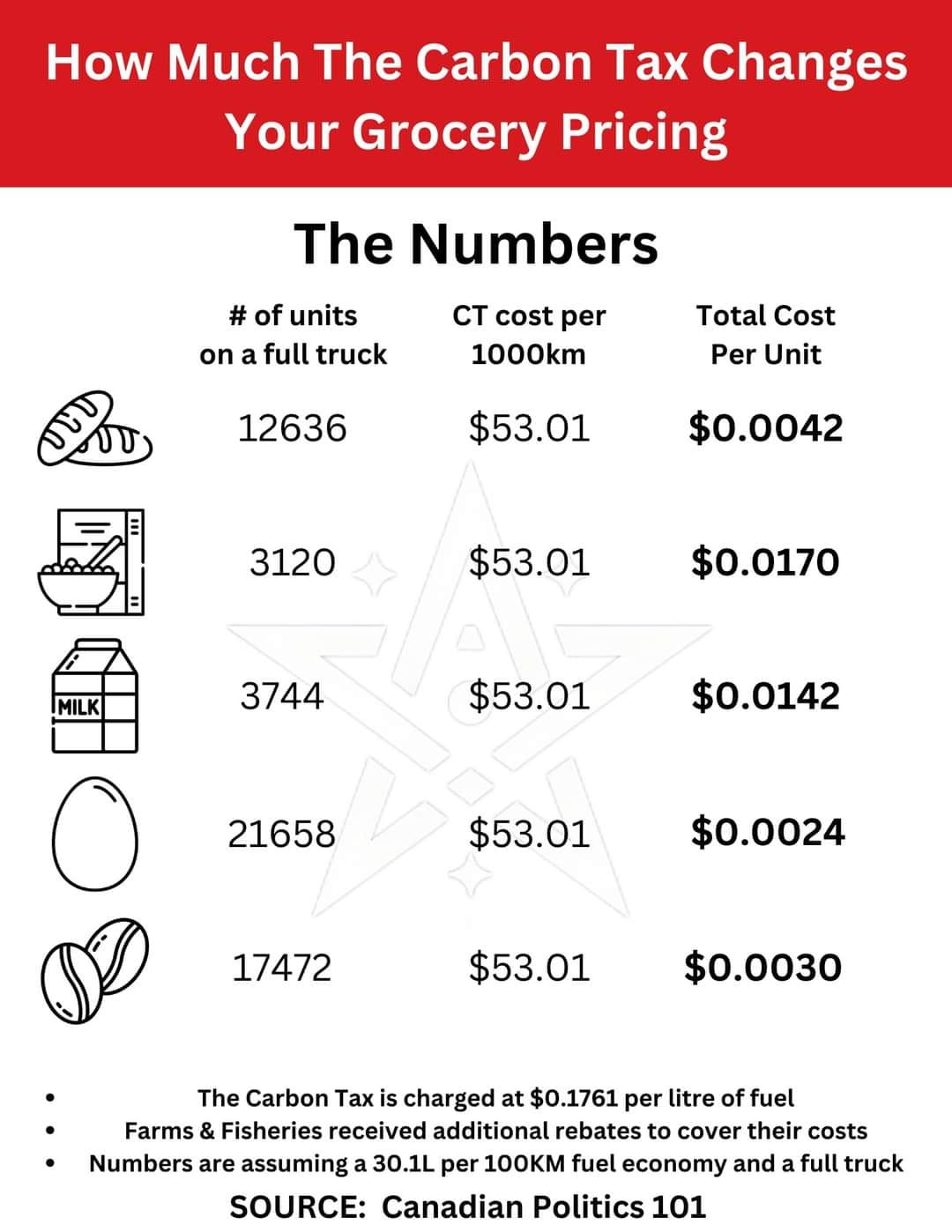

The provincial government continues to deny that the carbon tax is increasing prices for consumers across the board, while also insisting that carbon tax ends up putting more money in the pockets of most British Columbians, it’s clear from The Broken Typewriter’s recent and unscientific survey that that’s not the case.

Only 14 percent of respondents have received a carbon tax rebate.

It’s only a small poll, but the results are the complete opposite of the message that BC’s government is putting out, that 80 percent of British Columbians get a rebate. Or rather, a Climate Action Tax Credit if we’re referring to individuals.

In The Broken Typewriter’s survey, of the 14 percent of people who got money back from the government, 67 percent of those were personal rebates, which are automatically dispensed four times a year. The other 33 percent were for agriculture.

There are several ways farmers can get the carbon tax back, there’s a partial rebate if you are greenhouse producer, and then you can also apply to recoup the carbon tax on fuel, propane for motor vehicles and heating fuel. This doesn’t apply to natural gas, only propane. And of course, coloured gas for farm use is carbon-tax free.

However, not only is carbon tax charged on the natural gas used to dry grain – and drying grain is not a quick process – without a rebate to producers, but on top of that carbon tax are GST and PST. You may have noticed this on your household gas bill, they’re taxing the tax.

The Broken Typewriter has yet to come across any valid explanations for this tax upon a tax - have they not been asked, or have they managed to throw enough word salads around to distract the mainstream media and the public?

None of the survey participants received any business or industry carbon tax rebates.

Readers surveyed came from all over northeastern BC – with 79 percent in the North Peace, 5 percent in the South Peace, 5 percent in the Northern Rockies and 11 percent in Prince George.

While there were no questions about readers’ ethnicity in the survey, the BC government website says that First Nations have an exemption from both motor fuel tax and carbon tax if the fuel is purchased by eligible First Nations individuals and bands on First Nations land. But like farmers, they have to apply for the rebate. Again, it doesn’t seem to apply to natural gas, which is essential to keeping our homes warm in the Northern winters.

The carbon tax is scheduled to keep climbing, year after year, if the current governments remain in power following the coming elections – all the opposition parties, the Conservative Party of Canada, the BC Conservative Party and BC United; which in its previous incarnation as BC Liberals, foisted the carbon tax upon us in the first place; say they want to do away with the carbon tax.

I sincerely hope they do, whoever wins. Canada produces such a small amount of carbon, and we have millions upon millions of trees to offset any carbon footprint, yet unlike countries that do produce massive amounts of pollution, we are the ones who have to suffer.

Why should Canadians, British Columbians have to pay for the sins of other countries who continue to pollute at will? Especially when we have the means to help these countries reduce their carbon footprint with ethically produced LNG – for which we don’t get a rebate on the carbon tax we’re forced to pay.

Not that I want a rebate, I’d just like for things to be more affordable again, for everyone. And for climate policies to make sense. Let industry continue to reduce its emissions and drop the carbon tax.

As Marco Rubio said: “The government can’t change the weather.”

Yes, Rubio is American, not Canadian, but when was the last time any tax imposed by the government changed anything other than your bank balance?