FSJ has good overall financial position, with few areas of concern

Taxes were increased to mitigate increased costs caused by inflation

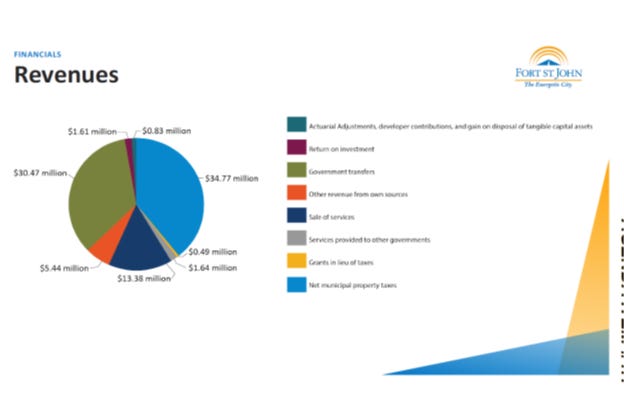

The City of Fort St. John is in the unique position of receiving more revenue from government grants and other sources, than through tax revenue, the city’s Chief Financial Officer, David Joy told council when presenting the city’s 2022 Annual Report.

Of the $88.6 million in revenue in 2022, $34.8 million came from municipal property taxes, the report showed. The single largest source of revenue, after property taxes is the Peace River Agreement funds, which added $25.9 million to the city’s coffers.

“Council has been very disciplined in the application of transfers from other levels of government, such a Peace River Agreement revenue,” Joy said. The city is “using that (revenue) to construct amenities for the community that will attract residents, such as upgrading Kin and Surerus Parks, the 100th Street corridor project, the new RCMP detachment, and new multi-use trails.”

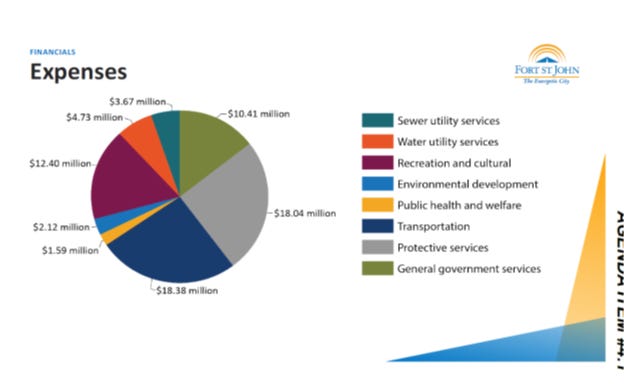

At a cost of just over $18 million each, Transportation and Protective Services are the city’s biggest expenses, with Recreational and Cultural Services coming in third at $12.4 million.

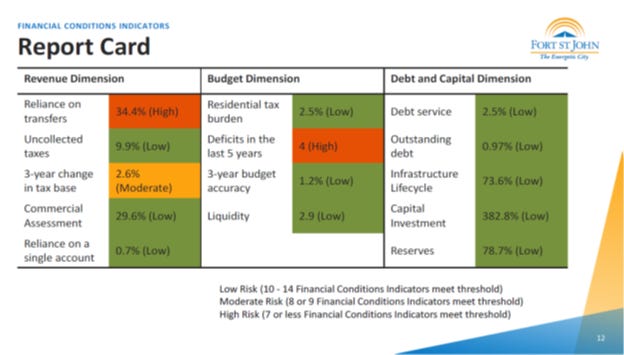

One of the methods the city uses to assess its financial conditions is by using the Financial Indicators Program, which was developed in Nova Scotia. The program uses 14 key indicators to assess a municipality’s risk, and provides a snapshot of its strengths and areas which may need attention. The indicators are split into three “dimensions”, Revenue, Budget, and Debt & Capital.

Overall, Fort St. John’s financial performance is good, but there are a few areas of concern. In the Revenue dimension, the city relies too much on transfers from other governments – a great portion of this is the Peace River Agreement. In the Budget dimension, there have been four deficits in the past 5 years. Muncipalities in BC are not allowed to budget for deficits, and must repay any deficits out of the next year’s tax levy. If there are multiple deficits in a short period, that might indicate a reduced ability to provide municipal services.

Mayor Lilia Hansen asked Joy about these deficits and where they’ve come from.

“The RCMP contract has gone up considerably,” he said. “The effect of inflation on our materials and supplies, and the supply chain issue has added to our costs.” That’s in addition to Covid and Covid-related expenses, which the city hasn’t fully recovered. The city, is not back to its pre-pandemic levels on the revenue side, he said, “but we’re getting there.”

What are we doing to mitigate the increased costs, Hansen asked.

Joy explained that the city raised property taxes, and “we are using more Peace River Agreement revenue to offset some of our operating expenses, and we’ve used some of our contingency reserve, so that we could reduce the amount of tax rate increase.”

To offset these increased costs, the additional amount used from the PRA was $1.5 million, or six per cent of the total PRA revenues. The contingency reserve ideally serves to help the city maintain operations in unique situations, such as during a wildfire or pandemic. These reserves are replenished when the city has a surplus at year-end.

Although the annual report is a report on the financial state of the city, Joy says it’s also an opportunity for the City to “demonstrate our strong commitment to transparency, accountability and effective governance. It allows the public to be aware of what we do in the different departments.”

If you’re interested in reading the City of Fort St. John’s 2022 Annual Report, or any previous report, you can find them on the city’s website https://www.fortstjohn.ca/EN/main/local-gov/annual-reports.html