City looks for ways to balance budget, raise revenues

The City of Fort St. John is facing several challenges, all of which impact the budget in some way, shape or form, according to Director of Finance, Shirley Collington, who presented the Draft Operating and Capital Budgets to council on January 27.

“Just to give you a heads-up, it’s not balanced,” Collington told council.

The intent of the budget is to build a community that is fiscally sound, committed to public safety, one with a vibrant city center, and that has quality services for its citizens.

The city is not alone in facing challenges, Collington said. Among Fort St. John’s challenges are increasing costs due to supply chain challenges, wages and benefits, increases in operating costs, downloading from higher levels of government, aging infrastructure renewal and maintenance, and demands for new services or increases in levels of service.

“All our citizens are always looking for new and more different things to do, and exciting things to do, as well as we want to invite new people in, so we need those new services,” she said.

The legislative challenges are another thing the city must face that impacts the budget.

“We get those changes that come down the pipe and then we have to re-adjust all our operational needs to meet that.”

Operating Budget:

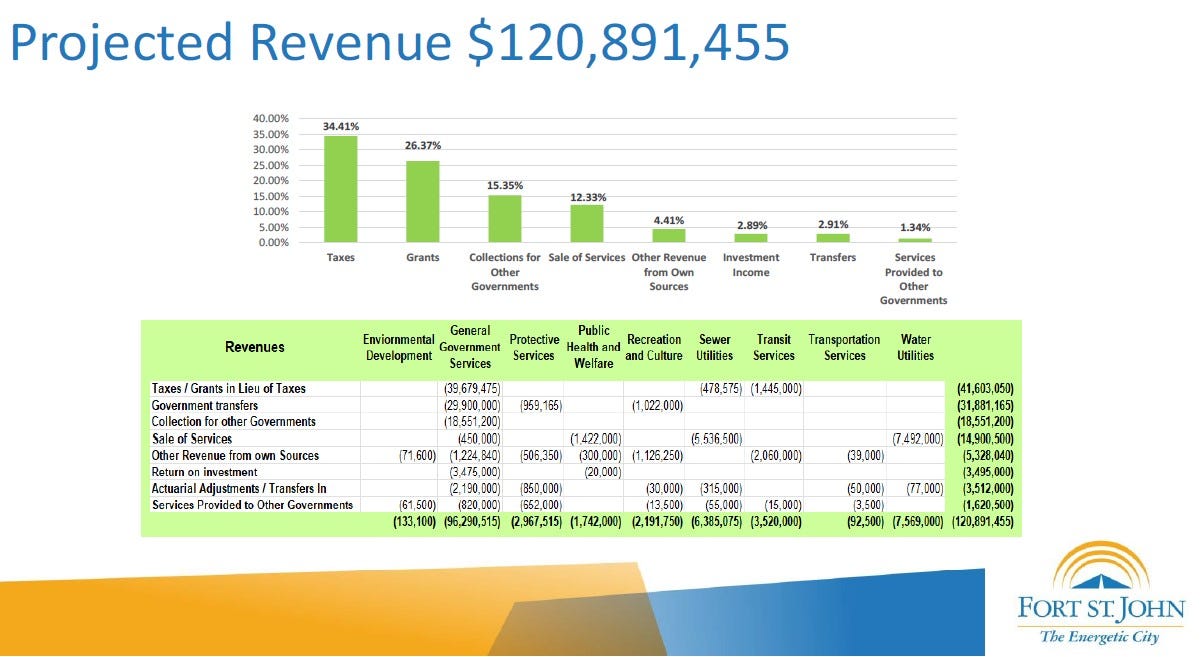

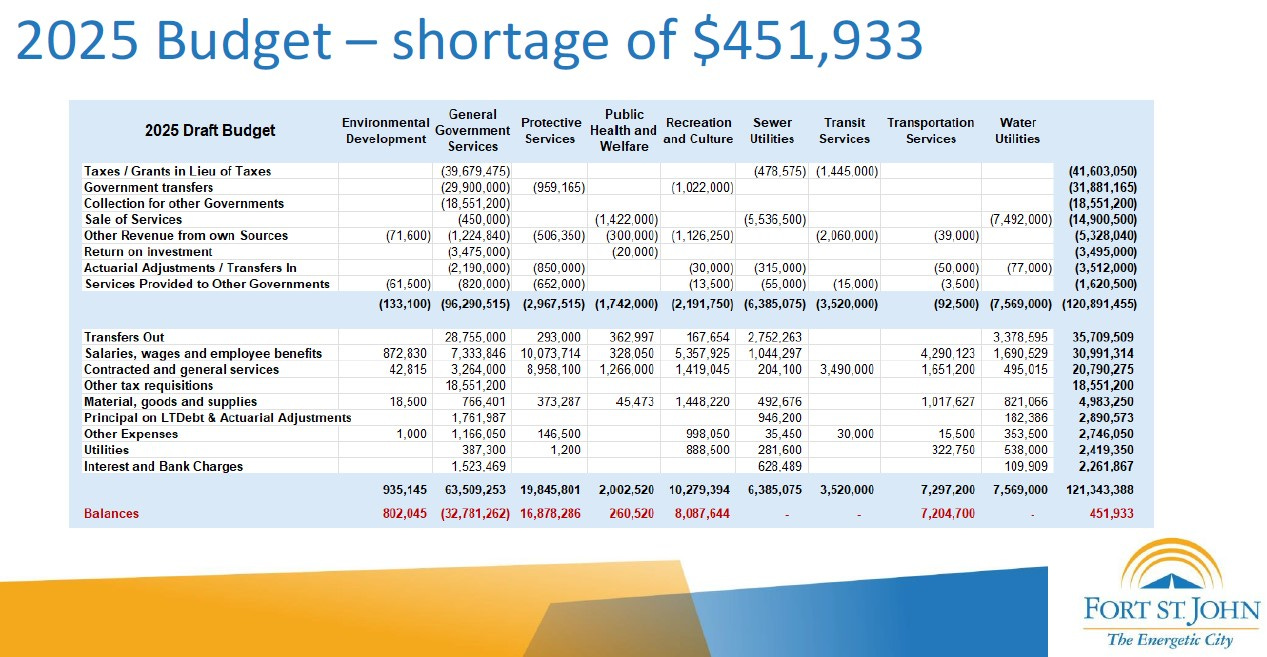

Currently, the city’s Operating Revenues are projected to be $120,891,455. While transfers in decreased by $571,132, all other forms of revenue increased, Collington reported.

The increases in revenues came from things like the Peace River Agreement funds increasing a bit, and facility rentals becoming more popular, thus generating more revenue, she said.

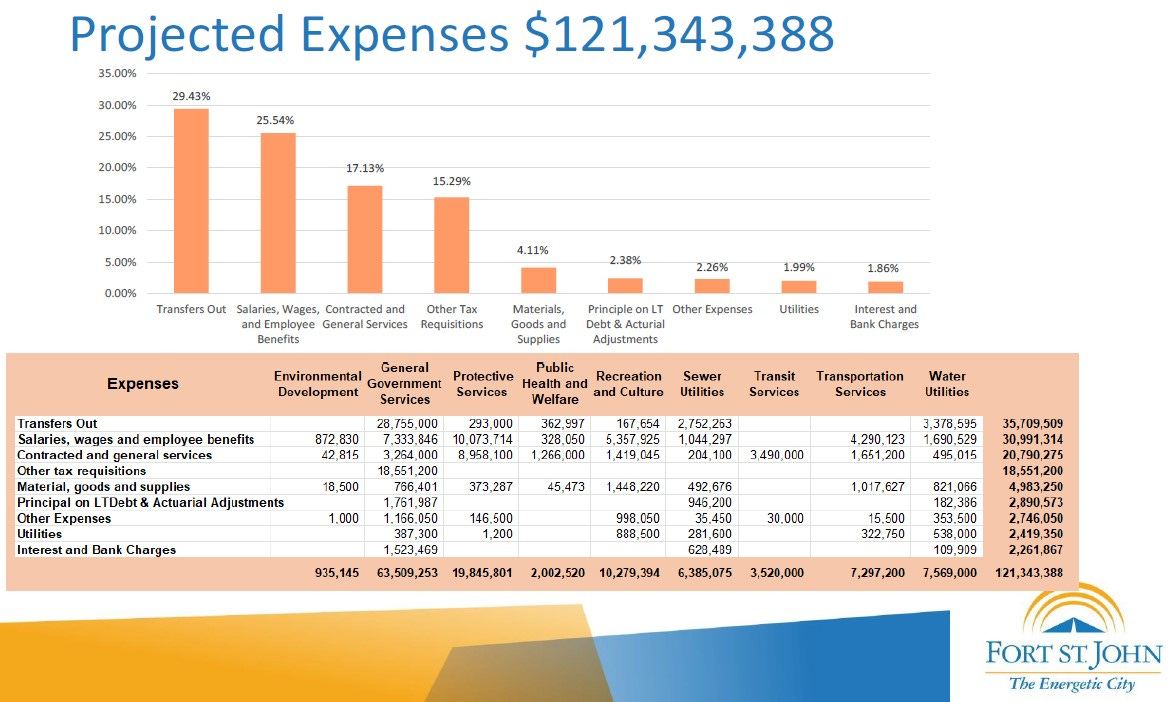

However, the Operating Expenses are projected to be 121,343,388 – resulting in a budget shortfall of $451,933.

Collington reported that materials, goods, and supplies; utilities; transfers out; and other expenses all decreased, together totalling $963,868. But at the same time, salaries, wages and benefits; contracted and general services; principle on long-term debt; and interest and bank charges all increased, together totalling $5,243,651.

The costs of utilities are down, because the new RCMP detachment is mostly solar, powered and there is no gas in that building. Conversely, the RCMP detachment building loan is largely responsible for the increases in bank charges.

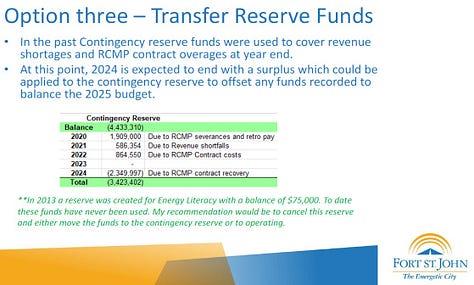

In her presentation, Collington also outlined a number of options to balance the budget which ranged from increasing tax revenue, to transferring contingency reserve funds to cover the shortfall, to reassessing current service levels.

To make up the shortfall in revenue, the easiest thing to do is to increase taxes.

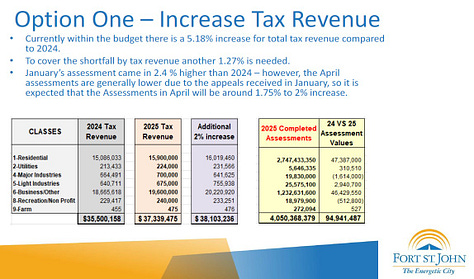

Included in the budget is a 5.18 percent total increase in tax revenue, based on numbers from BC Assessment. To make up the shortfall in the Operating Budget, Collington said that the city needs a total increase in tax revenue of 6.45 percent. This additional revenue could come from increasing the property taxes in the city by between 1.75 and 2 percent.

Councillor Gordon Klassen noted that it’s important to distinguish between tax revenue and the tax rate.

“Everybody’s going to freak out thinking they’re getting over 5 percent increase to their taxes but that’s not what we’re talking about.”

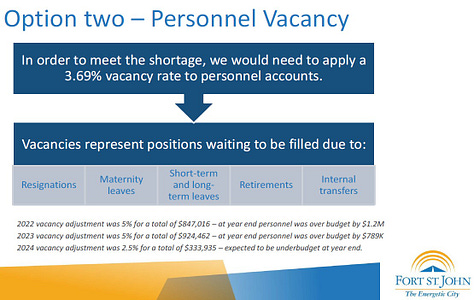

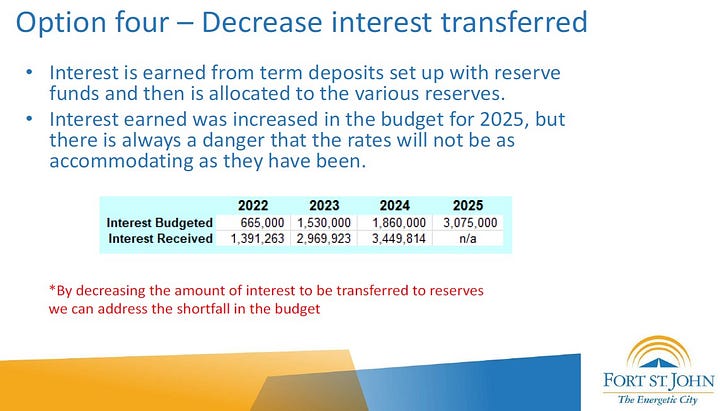

Knowing that large tax increases are not going to be very popular with residents and businesses, Collington laid out five other options to increase revenue.

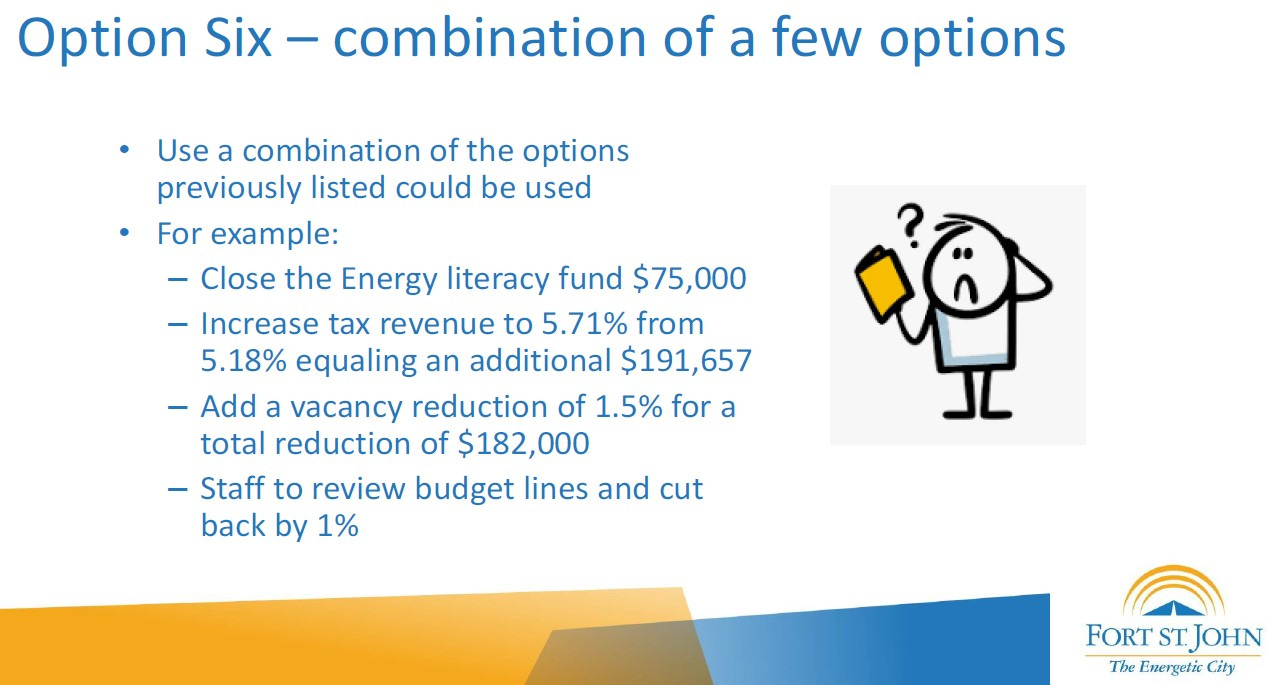

Option 6, which combines aspects of some of the other options – including closing the Energy Literacy Fund; increase tax revenue to 5.71 percent, which would mean a less than one percent increase in the property tax rate for residents and businesses; adding vacancy reduction of 1.5 percent; and reviewing budget lines to find cutbacks of approximately one percent.

Councillor Trevor Bolin was the first to endorse Option 6 as a potential plan to balance the Operating Budget.

“I think that’s going to the be the safest for the city, but I think it’s also going to be the most beneficial for the residents and the taxpayers. They’re not going to get this hike or big jump, but they’re going to know that we’ve rebuilt contingencies that we’ve used in the past,” Bolin said.

Council was unanimous in its support for Option 6.

“I do think it’s important that we look at all options, but that also includes review our budget lines and events. There’s things that we want to have but what can we afford. As much as we want to provide as many amenities and events for our community as possible, I think we also have to balance that with affordability,” said Mayor Lilia Hansen.

Capital Budget:

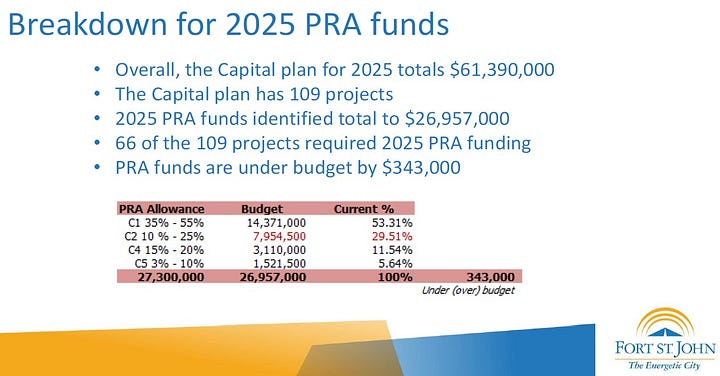

Thanks to the Peace River Agreement, the city’s Capital Budget is not only robust, but has a small surplus, Collington reported.

The Capital Plan has 109 projects, and 66 of those projects will make use of the PRA funding to complete them. The projects are divided into five components:

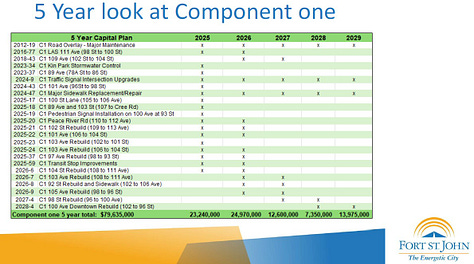

C1 projects include roads, sidewalks, streetlights, traffic lights, crosswalks, drainage and pedestrian crosswalks. There are two projects in this component leftover from 2024 that will be completed in 2025. There are nine new projects planned for 2025.

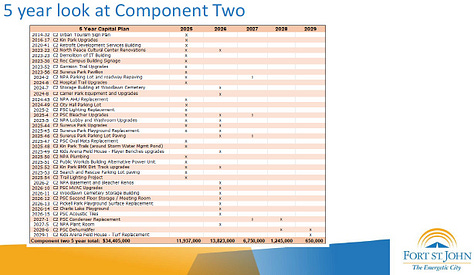

C2 projects include facilities, parks, trails and buildings. There are 10 projects in this component that were either started or planned for in 2024 that will carry over into 2025. Another 10 new projects are slated for 2025.

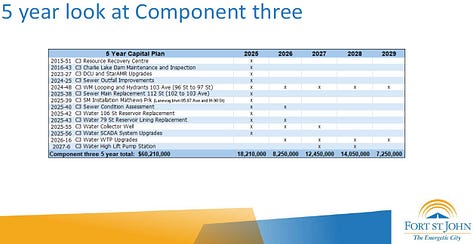

C3 projects are water and sewer infrastructure projects whose funding comes from the water and sewer reserves, not PRA funds. Two projects continue into 2025 from last year, while for 2025 five new maintenance projects are planned, as well as four new infrastructure projects, including the replacement of the 106 Street water reservoir.

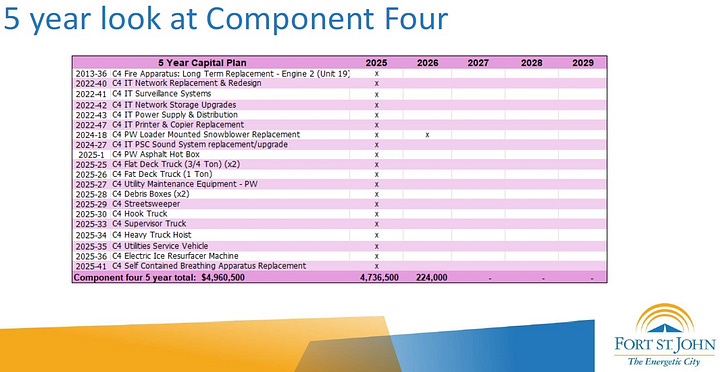

C4 projects are equipment replacements and additions, including such things as technical equipment, vehicles, office equipment, playground equipment, and heavy and light duty equipment. One of the top projects in this component for 2025 is a new fire truck.

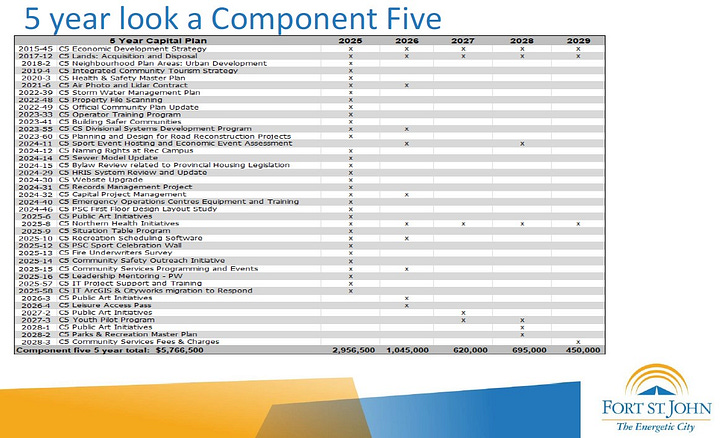

C5 projects are what Collington calls non-tangibles. This category supports the city’s operations, and includes studies, reports, planning, strategies, master plans and audits.

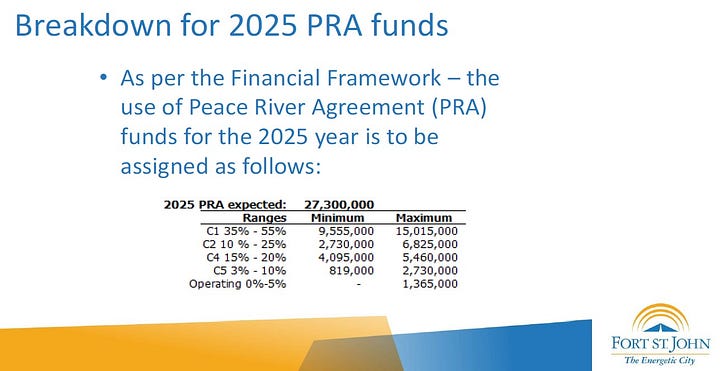

The overall Capital Plan for 2025 is $61.4 million, with the PRA funding covering $26.9 million of that.

Councillor Tony Zabinsky suggested looking at using the $343,000 amount that the capital plan is under budget to balance out the Operating Budget, but Deputy Chief Administrative Officer Darryl Blades nixed that idea.

“We are putting just shy of $1.4M of the PRA to balance our operating budget,” he said. To add any more funds from PRA to the Operating budget would exceed the allowable amount.

Other than a small portion, up to 10 percent of each year’s allotment, Peace River Agreement funds are only to be used for Capital Projects, not for operations.

“We don’t use taxation dollars for capital planning,” Collington explained. “Capital projects and infrastructure come strictly from infrastructure grants, which the PRA is one of them. As well as water and sewer, which comes from user fees, and other grants that we receive.

“We do have some reserves set aside, and again those reserves are identified for certain uses. If a project fits within that use, we can use reserve money for that.”

The PRA funds come from the provincial government and is approximately $26 million per year for infrastructure needs. Of all the communities in the region that receive PRA funds, Fort St. John receives the most as the funding formula is based on population and nearby industrial tax base.

Other municipalities in the southern part of the province must charge a percentage on their tax bills to collect capital funds.

“This may not last forever, there may come a time when we may have to go there,” Collington said. “If that comes down, then we will not be having such a big capital list.

“So, we’re trying to get as much done as we can now, while we do have this funding coming to us.”